This week, for the first time since mid-June, the 30-year fixed rate mortgage rate climbed on a week-over-week basis, moving 6 basis points to 3.55%, on average.

Should You Refinance?

You’ve seen it, probably a few dozen times in the last couple days (and probably for the last few weeks). On the news, online, tv commercials, and probably a few other places. Ohio Mortgage Interest Rates are at historical lows. It begs the question, should you refinance your mortgage? Most homeowners’ number one goal when […]

A Look Back at Housing Market Predictions For 2012

Analysts made bold calls at the start of the year about the housing and mortgage markets. How good were their predictions?

Ohio USDA Refinance

Recently USDA’s Rural Development release a new and improved refinance program. In the past, a homeowner that purchased their home with a USDA Rural Development mortgage could refinance into a new USDA Rural Development mortgage, but had to meet certain requirements, and often had to get an appraisal on their property. This made it nearly […]

Updated Fannie Mae Guidelines, Including HARP

Fannie Mae recently released an update to their Selling Guide (the place all of Fannie Mae’s guidelines are published). Below is a brief run down of these changes: Updates affecting Ohio HARP refinances Multiple Financed Properties for the Same Borrower – until now, a homeowner refinancing with the HARP program had to meet Fannie Mae’s […]

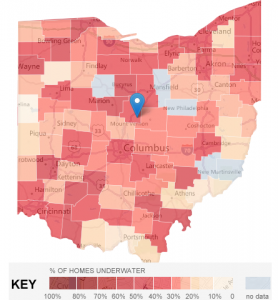

Ohio and Zillow’s Negative Equity Map

Recently Zillow released their “Negative Equity” map of the United States. The map shows the percentage of homes that are “underwater” or have negative equity. The data is presented county-by-county. Below is Zillow’s Negative Equity Map of the Ohio According to Zillow: 37% Hamilton County Properties are Underwater, and the average home value is $105,200 34% […]

Ohio Mortgage Rates

It’s been on the news, the radio, online, basically anywhere you look over the past few weeks you have seen that interest rates are at all time lows. So what does that mean for you? How much can you save? Well that depends on a lot of factors. Some of the factors that impact the interest […]

How to Get the Best Deal on a Refinance in Ohio

Interest rates are still at historic lows, and lenders are beginning to loosen up (albeit slightly) when it comes to lending. So what should a homeowner do to ensure that they get the best deal when they refinance their mortgage? Preparation There are a few things that a homeowner needs to do before making the […]

Ohio HARP 2.0 Refinance – UPDATE

HARP 2.0 for Ohio residents has been in full effect for 2 months now. I’ve covered the benefits of the Home Affordable Refinance Program. Now, let’s take a look at how things have gone for those that have decided to take advantage of the historically low rates. You can always complete the form to your […]

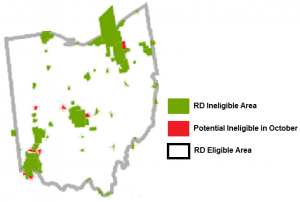

Ohio USDA Mortgage Loan Potential Changes

Ohio USDA Mortgage Loan applicants you have until October to get a USDA mortgage before possible re-alignment of USDA eligible areas may occur. All thanks to the 2010 Census. Everyone thought the 2010 census was a thing of the past, well think again. The data from the 2010 Census is going to cause USDA to […]