Understanding USDA Property Eligibility Criteria USDA home loans are aimed at uplifting rural communities across the United States, offering financial assistance to potential homebuyers in designated areas. However, to qualify for a USDA loan, a property must adhere to certain eligibility criteria, encompassing rural area designation, occupancy status, and the home’s physical condition. The good […]

2023 Ohio FHA Guidelines in a Nutshell

An Ohio FHA Mortgage is insured by the Federal Housing Administration (FHA), a federal agency run by the United States Department of Housing and Urban Development (HUD). The FHA Mortgage program’s goal is to promote homewoenrship, thus it is available to all buyers. Based on client feedback, these are the most pertinent guidelines that Ohio […]

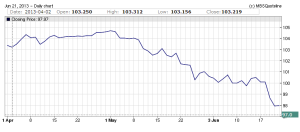

Ohio Mortgage Rates On the Rise

The last 2 days have been brutal for mortgage rates, but the trend started over a month ago. Ohio Mortgage Rates are driven by Mortgage Backed Securities, which according to Investopedia.com are “a type of asset-backed security that is secured by a mortgage or collection of mortgages.” Falling Mortgage Backed Security (MBS) prices equates to […]

Ohio HARP 2.0 Refinance – UPDATE

HARP 2.0 for Ohio residents has been in full effect for 2 months now. I’ve covered the benefits of the Home Affordable Refinance Program. Now, let’s take a look at how things have gone for those that have decided to take advantage of the historically low rates. You can always complete the form to your […]

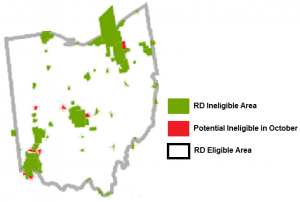

Ohio USDA Mortgage Loan Potential Changes

Ohio USDA Mortgage Loan applicants you have until October to get a USDA mortgage before possible re-alignment of USDA eligible areas may occur. All thanks to the 2010 Census. Everyone thought the 2010 census was a thing of the past, well think again. The data from the 2010 Census is going to cause USDA to […]

HARP 3.0? HELP FOR OHIO HOMEOWNERS

By now most have heard about HARP 2.0 (the re-work of the previously released Home Affordable Refinance Program). If not, then see my previous posts covering HARP 2.0 and the BENEFITS OF HARP 2.0 for a quick glimpse at the popular refinance program. As many of you know, if your current mortgage is not insured/owned by […]

BENEFITS OF HARP 2.0 REFINANCE?

The hot topic in the mortgage world over the last 2-3 weeks has been HARP 2.0. Clients calling about it, lenders emailing about it, loan officers looking for homeowners who qualify. See my earlier post detailing WHAT IS HARP 2.0 So what are the benefits of a HARP 2.0 refinance? Allows homeowners who are underwater […]

DON’T QUALIFY FOR HARP 2.0? HELP MAY BE ON ITS WAY

UPDATED: 4/24 (see below) The new HARP 2.0 Program officially rolled out this past week for those homeowners who have a mortgage insured by Fannie Mae / Freddie Mac. Click Here for HARP 2.0 Info But what about homeowners whose mortgage isn’t insured/owned by Fannie Mae, Freddie Mac, FHA, VA, USDA? Up until now, you […]

WHAT IS HARP 2.0?

HARP (Home Affordable Refinance Program) began in April 2009. You may have heard to it referred to as the Making Home Affordable Program, the Obama Refinance Plan or Relief Refinance Program. You are eligible for a HARP refinance if: Your current loan is owned/insured by Fannie Mae or Freddie Mac. Your current loan was purchased/insured […]

FHA MORTGAGE INSURANCE CHANGES

As mentioned in previous articles FHA MORTGAGE INSURANCE INCREASING and FHA POISED TO LOWER MIP FOR STREAMLINES FHA has decided to officially revised their mortgage insurance requirements on FHA streamline refinances as well as normal Purchase and Refinance FHA mortgages. Below are the new FHA mortgage insurance figures and their effective dates: FHA Streamline Refinances Effective with […]