So you are considering buying a house, and are either a First Time Homebuyer or haven’t purchased a home in a few years. What should you expect? Those of you who purchased a home 15+ years ago, might think its still the same process. Heartbeat – Check, ability to fog a mirror – Check, here’s […]

2023 Ohio FHA Guidelines in a Nutshell

An Ohio FHA Mortgage is insured by the Federal Housing Administration (FHA), a federal agency run by the United States Department of Housing and Urban Development (HUD). The FHA Mortgage program’s goal is to promote homewoenrship, thus it is available to all buyers. Based on client feedback, these are the most pertinent guidelines that Ohio […]

5 Questions To Ask Your Loan Officer

There are some obvious questions to ask your loan officer, such as what is the interest rate? How much is the mortgage payment? How much are the closing costs? There are some other questions that you should ask in addition to the obvious ones. What should I expect during the loan process? Many aspects of the […]

Ohio Jumbo Mortgage Facts

A Jumbo Mortgage is any home loan that exceeds the conforming loan limit set by the Federal Housing Finance Agency (FHFA). Below are a few facts to assist you when looking for an Ohio Jumbo Mortgage. Ohio Jumbo Loan limits In Ohio the conforming loan limit is $417,000. Any mortgage loan that exceeds this amount will […]

Top 4 Reasons To Buy a Home in Ohio in 2016

Low Rates Contrary to what you may have been led to believe from the nightly news, mortgage rates are still extremely low. The Fed did raise the target funds rate by a quarter-point in December. The first increase since 2006. An increase to the target funds rate does not equal an increase to mortgage rates. […]

New Mortgage Regulations and What They Mean To You

At the beginning of October, the mortgage industry saw one of the biggest changes to closing paperwork become a reality. On October 3rd, the new TILA-RESPA Integrated Disclosures (TRID) became required for all loans. These TRID disclosures combined four forms into two that are easier for borrowers to understand. The two new forms are the […]

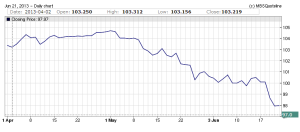

Ohio Mortgage Rates On the Rise

The last 2 days have been brutal for mortgage rates, but the trend started over a month ago. Ohio Mortgage Rates are driven by Mortgage Backed Securities, which according to Investopedia.com are “a type of asset-backed security that is secured by a mortgage or collection of mortgages.” Falling Mortgage Backed Security (MBS) prices equates to […]

Ohio Homebuyer’s 6 Absolute Do Not’s

Ohio’s housing market has picked up steam over the last few months. There are plenty of things that prospective Ohio homebuyers should not do, and this article could exceed 5000 words if we discussed them all. So let’s just look at the important ones. With so many residents in Ohio looking to buy a home, […]

Buying a Home in Ohio? Get In Line.

Over the last few months I have talked to many clients seeking to buy a home. From first time homebuyers and seasoned home buyers and from newlyweds to relocations. One thing that has been similar is the number of offers they have had to submit before they had one accepted. The housing market in Ohio, […]

Ohio Private Mortgage Insurance (PMI) Tax Deductible

The Fiscal Cliff is averted. The American Taxpayer Relief Act of 2012 was signed into law by President Obama on Wednesday, avoiding the tax hikes and cuts in spending that were on the horizon. One of the lesser known, or at least lesser discussed, provisions in the Act is that it extends the ability to deduct the […]