Fannie Mae has just announced new Loan Level Price Adjustments (LLPAs) that go into effect for loans purchased on or before March 31, 2014. A mortgage must close, before it can be “purchased” on the secondary market. My best guess is that lenders will begin to carry out these new LLPAs for loan submitted after […]

Ohio Mortgage Rates On the Rise

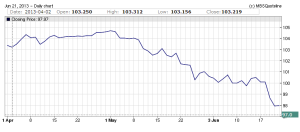

The last 2 days have been brutal for mortgage rates, but the trend started over a month ago. Ohio Mortgage Rates are driven by Mortgage Backed Securities, which according to Investopedia.com are “a type of asset-backed security that is secured by a mortgage or collection of mortgages.” Falling Mortgage Backed Security (MBS) prices equates to […]

Ohio HARP Refinance – Petition to Extend Qualifying Date

HARP (Home Affordable Refinance Program) was set up by the Federal Housing Finance Agency (FHFA) in March 2009 to aid homeowners who were underwater, or close to being underwater, refinance into lower rate mortgage. In December 2011 the program was modified, HARP 2.0. Since the inception of the program, one of the main factors that […]

Ohio HARP Refinance is Still A Good Option

With the recent spike in interest rates, see chart below Homeowners may shy away from the idea of refinancing their mortgage because a) rates are higher now than they were last month or b) they don’t think they qualify. Objection A is correct, rates are higher today than they were a month ago. However, they […]

Ohio Homebuyer’s 6 Absolute Do Not’s

Ohio’s housing market has picked up steam over the last few months. There are plenty of things that prospective Ohio homebuyers should not do, and this article could exceed 5000 words if we discussed them all. So let’s just look at the important ones. With so many residents in Ohio looking to buy a home, […]

Ohio HARP Refinance Extended to 2015

The Federal Housing Finance Agency (FHFA) directed Fannie Mae (FNMA) and Freddie Mac (FHLMC) to extend the Home Affordable Refinance Program (HARP) to December 31, 2015. This is a 2 year extension, as HARP was set to expire at the end of 2013. Ohio homeowners that meet the following criteria may be eligible for a […]

Buying a Home in Ohio? Get In Line.

Over the last few months I have talked to many clients seeking to buy a home. From first time homebuyers and seasoned home buyers and from newlyweds to relocations. One thing that has been similar is the number of offers they have had to submit before they had one accepted. The housing market in Ohio, […]

Ohio HARP 3.0 Refinance?

The Home Affordable Refinance Program (HARP) launched in 2009 as a means to aid homeowners to take advantage of low interest rates. The program expanded in 2012 with the release of HARP 2.0, which removed the loan to value caps, and opened the market up to many more homeowners. President Obama, in his 2012 State […]

Ohio Private Mortgage Insurance (PMI) Tax Deductible

The Fiscal Cliff is averted. The American Taxpayer Relief Act of 2012 was signed into law by President Obama on Wednesday, avoiding the tax hikes and cuts in spending that were on the horizon. One of the lesser known, or at least lesser discussed, provisions in the Act is that it extends the ability to deduct the […]

Ohio Mortgage Update, Fannie Mae Appraisal Changes Coming

Earlier this summer Fannie Mae announced a major update to its Automated Underwriting System (AUS) known as Desktop Originator/Desktop Underwriter (DO/DU). With this update, the days of drive-by appraisals will be over. So what does this mean to homeowners? Be ready to pay for a full appraisal, upwards of $400 with most lenders. Currently, once […]