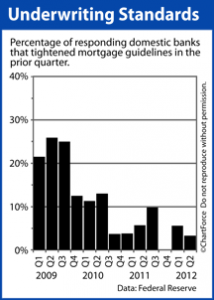

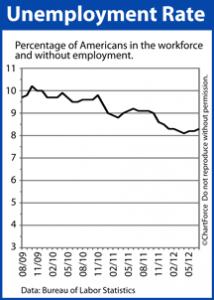

As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending standards.

Mortgage Rates, What Lies Ahead – August 6, 2012

Mortgage bonds worsened last week, moving to a near-6 week high.

30 Year Fixed Mortgage Rate Rises To 4 Week High

This week, for the first time since mid-June, the 30-year fixed rate mortgage rate climbed on a week-over-week basis, moving 6 basis points to 3.55%, on average.

Updated Fannie Mae Guidelines, Including HARP

Fannie Mae recently released an update to their Selling Guide (the place all of Fannie Mae’s guidelines are published). Below is a brief run down of these changes: Updates affecting Ohio HARP refinances Multiple Financed Properties for the Same Borrower – until now, a homeowner refinancing with the HARP program had to meet Fannie Mae’s […]

Ohio Mortgage Rates

It’s been on the news, the radio, online, basically anywhere you look over the past few weeks you have seen that interest rates are at all time lows. So what does that mean for you? How much can you save? Well that depends on a lot of factors. Some of the factors that impact the interest […]

How to Get the Best Deal on a Refinance in Ohio

Interest rates are still at historic lows, and lenders are beginning to loosen up (albeit slightly) when it comes to lending. So what should a homeowner do to ensure that they get the best deal when they refinance their mortgage? Preparation There are a few things that a homeowner needs to do before making the […]

New Government Mortgage Programs, Good Idea?

President Obama has been making news recently in the housing industry. He has made comments on making FHA Streamline Refinances more accessible, and Wednesday morning the White House released some details on the President’s latest refinance plan. Minimum credit score of 580, and loan to value ratio (loan amount compared to the homes value) of […]

OHIO RESIDENTS, GET READY FOR MORTGAGE COSTS TO GO UP

The payroll tax cut extension that Congress agreed to extend on December 23rd will have far reaching implications. One of those implications is increasing the cost of a mortgage for those of us in Ohio and across the country. The loan guarantee fee paid by Fannie Mae and Freddie Mac will increase by 10 BPS […]