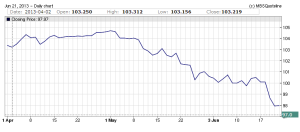

The last 2 days have been brutal for mortgage rates, but the trend started over a month ago. Ohio Mortgage Rates are driven by Mortgage Backed Securities, which according to Investopedia.com are “a type of asset-backed security that is secured by a mortgage or collection of mortgages.” Falling Mortgage Backed Security (MBS) prices equates to […]

Ohio Homebuyer’s 6 Absolute Do Not’s

Ohio’s housing market has picked up steam over the last few months. There are plenty of things that prospective Ohio homebuyers should not do, and this article could exceed 5000 words if we discussed them all. So let’s just look at the important ones. With so many residents in Ohio looking to buy a home, […]

Buying a Home in Ohio? Get In Line.

Over the last few months I have talked to many clients seeking to buy a home. From first time homebuyers and seasoned home buyers and from newlyweds to relocations. One thing that has been similar is the number of offers they have had to submit before they had one accepted. The housing market in Ohio, […]

Ohio FHA Changes Coming Soon…

The following 2 articles were originally posted at Ohio FHA regarding upcoming changes to FHA’s mortgage insurance guidelines: FHA Increasing Annual Mortgage Insurance, Again HUD Mortgagee Letter 2013-04, released January 31, 2013 details HUD’s new increase for FHA mortgage insurance. Effective with FHA Case Numbers assigned on or after April 1, 2013 HUD is raising FHA’s […]

Ohio Mortgage Rate Alert – Why Have Rates Moved Higher?

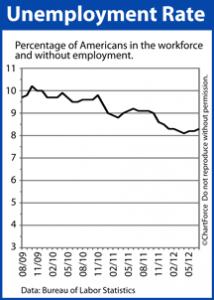

After reaching record lows near the end of July, mortgage rates have moved steadily higher this month. From their peak around July 24, mortgage rates have increased one-quarter point or more. Prior to July 26, two primary factors were responsible for the decline to record lows. First, the European debt troubles caused investors to shift […]

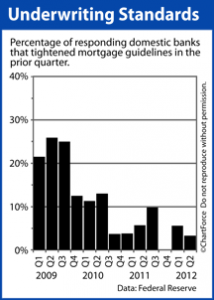

Ohio Mortgage Standards To Loosen?

As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending standards.

Mortgage Rates, What Lies Ahead – August 6, 2012

Mortgage bonds worsened last week, moving to a near-6 week high.

Ohio Mortgage Rates

It’s been on the news, the radio, online, basically anywhere you look over the past few weeks you have seen that interest rates are at all time lows. So what does that mean for you? How much can you save? Well that depends on a lot of factors. Some of the factors that impact the interest […]

How to Get the Best Deal on a Refinance in Ohio

Interest rates are still at historic lows, and lenders are beginning to loosen up (albeit slightly) when it comes to lending. So what should a homeowner do to ensure that they get the best deal when they refinance their mortgage? Preparation There are a few things that a homeowner needs to do before making the […]

FHA MORTGAGE INSURANCE CHANGES

As mentioned in previous articles FHA MORTGAGE INSURANCE INCREASING and FHA POISED TO LOWER MIP FOR STREAMLINES FHA has decided to officially revised their mortgage insurance requirements on FHA streamline refinances as well as normal Purchase and Refinance FHA mortgages. Below are the new FHA mortgage insurance figures and their effective dates: FHA Streamline Refinances Effective with […]