At the beginning of October, the mortgage industry saw one of the biggest changes to closing paperwork become a reality. On October 3rd, the new TILA-RESPA Integrated Disclosures (TRID) became required for all loans. These TRID disclosures combined four forms into two that are easier for borrowers to understand. The two new forms are the […]

Ohio Home Affordable Refinance (HARP) Program in 2014

Over the last year home prices in Ohio have begun to rebound, as you can see on the following chart from Zillow. Ohio Zillow Home Value Index Ohio real estate info How does that affect Ohio HARP 2.0 mortgages? The main goal of the Home Affordbale Refinance Program was to aid Ohio homeowners that are underwater […]

Fannie Mae Fee Increase Delayed!

First good news of 2014. Last month I published an article about Fannie Mae’s new Loan Level Price Adjustments (LLPAs) and the impact they would have on Mortgage Rates in Ohio. Good News Ohio! On Monday Mel Watt was sworn in as director of the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae and […]

Ohio Homeowners, Why Now Might Be Your Last Chance for a Low Rate

Rates are on the rise. There is no simpler way to put it. So if you have been on the fence, waiting for rates to dip back down into the 3’s, you may be waiting for quite a while, if not forever. Freddie Mac’s Chief Economist, Frank Nothaft stated in November “..we look for fixed-rate mortgage […]

Ohio Mortgage Market News for the week ending December 20, 2013

as provided by Fed Announces Taper Heading into Wednesday’s highly anticipated Fed meeting, investors were divided about what the Fed statement would reveal. The Fed announced that it will begin to scale back its bond purchase program. The stock market rallied after the news, but mortgage rates rose modestly and ended the week a […]

Ohio Mortgage Rates On the Rise

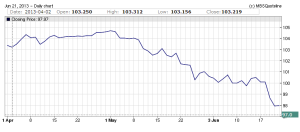

The last 2 days have been brutal for mortgage rates, but the trend started over a month ago. Ohio Mortgage Rates are driven by Mortgage Backed Securities, which according to Investopedia.com are “a type of asset-backed security that is secured by a mortgage or collection of mortgages.” Falling Mortgage Backed Security (MBS) prices equates to […]

Ohio HARP Refinance – Petition to Extend Qualifying Date

HARP (Home Affordable Refinance Program) was set up by the Federal Housing Finance Agency (FHFA) in March 2009 to aid homeowners who were underwater, or close to being underwater, refinance into lower rate mortgage. In December 2011 the program was modified, HARP 2.0. Since the inception of the program, one of the main factors that […]

Ohio HARP Refinance is Still A Good Option

With the recent spike in interest rates, see chart below Homeowners may shy away from the idea of refinancing their mortgage because a) rates are higher now than they were last month or b) they don’t think they qualify. Objection A is correct, rates are higher today than they were a month ago. However, they […]

Ohio HARP Refinance Extended to 2015

The Federal Housing Finance Agency (FHFA) directed Fannie Mae (FNMA) and Freddie Mac (FHLMC) to extend the Home Affordable Refinance Program (HARP) to December 31, 2015. This is a 2 year extension, as HARP was set to expire at the end of 2013. Ohio homeowners that meet the following criteria may be eligible for a […]

Ohio HARP 3.0 Refinance?

The Home Affordable Refinance Program (HARP) launched in 2009 as a means to aid homeowners to take advantage of low interest rates. The program expanded in 2012 with the release of HARP 2.0, which removed the loan to value caps, and opened the market up to many more homeowners. President Obama, in his 2012 State […]