Earlier this summer Fannie Mae announced a major update to its Automated Underwriting System (AUS) known as Desktop Originator/Desktop Underwriter (DO/DU). With this update, the days of drive-by appraisals will be over. So what does this mean to homeowners? Be ready to pay for a full appraisal, upwards of $400 with most lenders. Currently, once […]

Ohio Mortgage Rate Alert – Why Have Rates Moved Higher?

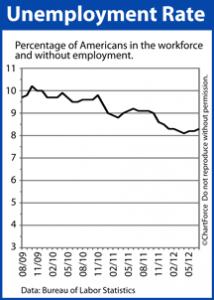

After reaching record lows near the end of July, mortgage rates have moved steadily higher this month. From their peak around July 24, mortgage rates have increased one-quarter point or more. Prior to July 26, two primary factors were responsible for the decline to record lows. First, the European debt troubles caused investors to shift […]

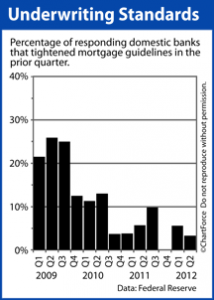

Ohio Mortgage Standards To Loosen?

As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending standards.

Mortgage Rates, What Lies Ahead – August 6, 2012

Mortgage bonds worsened last week, moving to a near-6 week high.

Updated Fannie Mae Guidelines, Including HARP

Fannie Mae recently released an update to their Selling Guide (the place all of Fannie Mae’s guidelines are published). Below is a brief run down of these changes: Updates affecting Ohio HARP refinances Multiple Financed Properties for the Same Borrower – until now, a homeowner refinancing with the HARP program had to meet Fannie Mae’s […]

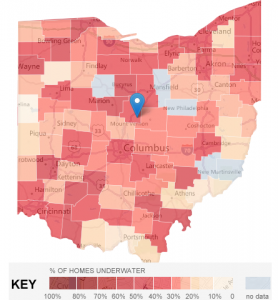

Ohio and Zillow’s Negative Equity Map

Recently Zillow released their “Negative Equity” map of the United States. The map shows the percentage of homes that are “underwater” or have negative equity. The data is presented county-by-county. Below is Zillow’s Negative Equity Map of the Ohio According to Zillow: 37% Hamilton County Properties are Underwater, and the average home value is $105,200 34% […]

Ohio Mortgage Rates

It’s been on the news, the radio, online, basically anywhere you look over the past few weeks you have seen that interest rates are at all time lows. So what does that mean for you? How much can you save? Well that depends on a lot of factors. Some of the factors that impact the interest […]

How to Get the Best Deal on a Refinance in Ohio

Interest rates are still at historic lows, and lenders are beginning to loosen up (albeit slightly) when it comes to lending. So what should a homeowner do to ensure that they get the best deal when they refinance their mortgage? Preparation There are a few things that a homeowner needs to do before making the […]

Ohio HARP 2.0 Refinance – UPDATE

HARP 2.0 for Ohio residents has been in full effect for 2 months now. I’ve covered the benefits of the Home Affordable Refinance Program. Now, let’s take a look at how things have gone for those that have decided to take advantage of the historically low rates. You can always complete the form to your […]

National Mortgage Settlement, Help For Ohio Homeowners

Ohio homeowners who don’t qualify for a refinance under the HARP 2.0, FHA Streamline, or other options currently available may have some assistance on the way. I discussed options for Ohio homeowners who do not qualify for a HARP 2.0previously. The National Mortgage Settlement website is now live, with important info for homeowners who have […]