There are some obvious questions to ask your loan officer, such as what is the interest rate? How much is the mortgage payment? How much are the closing costs? There are some other questions that you should ask in addition to the obvious ones. What should I expect during the loan process? Many aspects of the […]

Ohio Mortgage Market News for the week ending December 20, 2013

as provided by Fed Announces Taper Heading into Wednesday’s highly anticipated Fed meeting, investors were divided about what the Fed statement would reveal. The Fed announced that it will begin to scale back its bond purchase program. The stock market rallied after the news, but mortgage rates rose modestly and ended the week a […]

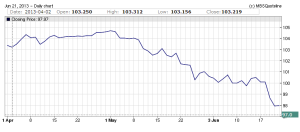

Ohio Mortgage Rates On the Rise

The last 2 days have been brutal for mortgage rates, but the trend started over a month ago. Ohio Mortgage Rates are driven by Mortgage Backed Securities, which according to Investopedia.com are “a type of asset-backed security that is secured by a mortgage or collection of mortgages.” Falling Mortgage Backed Security (MBS) prices equates to […]

National Mortgage Settlement, Help For Ohio Homeowners

Ohio homeowners who don’t qualify for a refinance under the HARP 2.0, FHA Streamline, or other options currently available may have some assistance on the way. I discussed options for Ohio homeowners who do not qualify for a HARP 2.0previously. The National Mortgage Settlement website is now live, with important info for homeowners who have […]

HARP 3.0? HELP FOR OHIO HOMEOWNERS

By now most have heard about HARP 2.0 (the re-work of the previously released Home Affordable Refinance Program). If not, then see my previous posts covering HARP 2.0 and the BENEFITS OF HARP 2.0 for a quick glimpse at the popular refinance program. As many of you know, if your current mortgage is not insured/owned by […]

DON’T QUALIFY FOR HARP 2.0? HELP MAY BE ON ITS WAY

UPDATED: 4/24 (see below) The new HARP 2.0 Program officially rolled out this past week for those homeowners who have a mortgage insured by Fannie Mae / Freddie Mac. Click Here for HARP 2.0 Info But what about homeowners whose mortgage isn’t insured/owned by Fannie Mae, Freddie Mac, FHA, VA, USDA? Up until now, you […]

New Government Mortgage Programs, Good Idea?

President Obama has been making news recently in the housing industry. He has made comments on making FHA Streamline Refinances more accessible, and Wednesday morning the White House released some details on the President’s latest refinance plan. Minimum credit score of 580, and loan to value ratio (loan amount compared to the homes value) of […]

OHIO RESIDENTS, GET READY FOR MORTGAGE COSTS TO GO UP

The payroll tax cut extension that Congress agreed to extend on December 23rd will have far reaching implications. One of those implications is increasing the cost of a mortgage for those of us in Ohio and across the country. The loan guarantee fee paid by Fannie Mae and Freddie Mac will increase by 10 BPS […]

Is Your Mortgage Underwater in Ohio?

60 Minutes aired a segment Sunday night covering Cleveland, OH and its foreclosure situation. You can see the story here THERE GOES THE NEIGHBORHOOD Many homeowners in Ohio have seen their homes value decline by up to 50% over the last couple of years. Continuing to pay a mortgage on a home that is now […]