There are some obvious questions to ask your loan officer, such as what is the interest rate? How much is the mortgage payment? How much are the closing costs? There are some other questions that you should ask in addition to the obvious ones. What should I expect during the loan process? Many aspects of the […]

Top 4 Reasons To Buy a Home in Ohio in 2016

Low Rates Contrary to what you may have been led to believe from the nightly news, mortgage rates are still extremely low. The Fed did raise the target funds rate by a quarter-point in December. The first increase since 2006. An increase to the target funds rate does not equal an increase to mortgage rates. […]

New Mortgage Regulations and What They Mean To You

At the beginning of October, the mortgage industry saw one of the biggest changes to closing paperwork become a reality. On October 3rd, the new TILA-RESPA Integrated Disclosures (TRID) became required for all loans. These TRID disclosures combined four forms into two that are easier for borrowers to understand. The two new forms are the […]

Whats New for Ohio Mortgages in 2014?

2014 is already a few days old, so let’s go over some of the changes that are already on tap for the mortgage industry this year. Qualified Mortgages (QM) rules from the Consumer Financial Protection Bureau (CFPB) go into effect this Friday, January 10, 2014. Basically this rule will put a borrowers loan into one […]

Ohio Homeowners, Why Now Might Be Your Last Chance for a Low Rate

Rates are on the rise. There is no simpler way to put it. So if you have been on the fence, waiting for rates to dip back down into the 3’s, you may be waiting for quite a while, if not forever. Freddie Mac’s Chief Economist, Frank Nothaft stated in November “..we look for fixed-rate mortgage […]

Ohio Mortgage Rates On the Rise

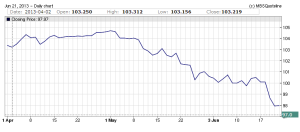

The last 2 days have been brutal for mortgage rates, but the trend started over a month ago. Ohio Mortgage Rates are driven by Mortgage Backed Securities, which according to Investopedia.com are “a type of asset-backed security that is secured by a mortgage or collection of mortgages.” Falling Mortgage Backed Security (MBS) prices equates to […]

Ohio Homebuyer’s 6 Absolute Do Not’s

Ohio’s housing market has picked up steam over the last few months. There are plenty of things that prospective Ohio homebuyers should not do, and this article could exceed 5000 words if we discussed them all. So let’s just look at the important ones. With so many residents in Ohio looking to buy a home, […]

Buying a Home in Ohio? Get In Line.

Over the last few months I have talked to many clients seeking to buy a home. From first time homebuyers and seasoned home buyers and from newlyweds to relocations. One thing that has been similar is the number of offers they have had to submit before they had one accepted. The housing market in Ohio, […]

Ohio Mortgage Rate Alert – Why Have Rates Moved Higher?

After reaching record lows near the end of July, mortgage rates have moved steadily higher this month. From their peak around July 24, mortgage rates have increased one-quarter point or more. Prior to July 26, two primary factors were responsible for the decline to record lows. First, the European debt troubles caused investors to shift […]

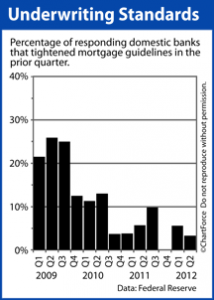

Ohio Mortgage Standards To Loosen?

As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending standards.