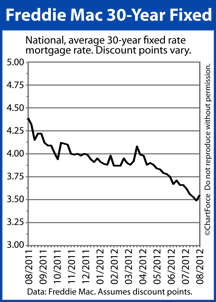

Mortgage rates couldn’t stay at historical lows forever.

The 30 year fixed mortgage rate climbed (on a week over week basis) for the first time since mid June, climbing 6 basis points to 3.55% on average across the nation.

Per Freddie Mac, the highest average rate which the benchmark product has been offered in the last 4 weeks is the 3.55% being offered this week.

Keep in mind, the Freddie Mac published mortgage rate assumes the following: a)available for prime borrowers and b)borrowers are paying full closing costs and an extra 0.7 discount points.

Discount points are paid at closing, and are an upfront loan fee. One discount point is equal to one percent of the loan amount. A Dayton home buyer who pays one discount point at closing will be responsible for an extra $1,000 in closing costs per $100,000 borrowed.

Even though Freddie Mac states that the average mortgage rate is 3.55%, not everyone who applies for a conforming mortgage will get access to the benchmark rate. Only “prime” borrowers are offered the rate. A “prime” borrowers is someone who:

- Has high credit scores, generally over 740

- Is able to document their income with W-2s and/or Federal income tax returns

- Has at least 25% equity in their home

Borrowers who don’t meet the above would expect a slightly higher interest rate and/or discount points. Mortgage interest rates could be as much as 0.50% higher for applicant’s who have credit scores below 680.

Although mortgage interest rates rose this week, the effect on home affordability is next to nothing. The increase in mortgage rates causes an increase of $3 per month per $100,000 borrowed compared to last week. The silver lining? 3.55% is still the 3rd lowest rate that Freddie Mac has ever offered.

As mortgage rates remain uncertain, there is no guarantee that these historically low-interest rates are going to last forever, or for that matter through the end of August. If you would like to check your options or are ready to lock a rate in fill out the simple Ohio Mortgage Rate Quote request form.