Mortgage rates rose last week in a news and event filled week. The world’s central banks, including the U.S.’s Federal Reserve, remained indecisive and towards the end of the week a better than expected jobs report bumped mortgage rates to their highest levels in more than 4 weeks.

Mortgage rates rose last week in a news and event filled week. The world’s central banks, including the U.S.’s Federal Reserve, remained indecisive and towards the end of the week a better than expected jobs report bumped mortgage rates to their highest levels in more than 4 weeks.

Conforming mortgage rates, along with FHA and USDA mortgage rates rose in Cincinnati and across the nation last week.

The week opened with mortgage markets in rally mode. The European Central Bank had stated that it would do whatever was necessary to preserve the European Union. However, details on that plan never emerged, leading to investors moving money to security, bonds (which includes mortgage backed securities).

Mortgage interest rates proceeded to drop on both Monday and Tuesday.

Wednesday afternoon mortgage rates spiked. The timing coincides with the end of the Federal Open Market Committee’s 2 day meeting and the FOMC’s statement to the markets. In the statement, the FOMC stated it would leave the Fed Funds Rate (the rate that banks lend each other money) unchanged in its target range of 0.00 – 0.25%, and that it will not add new stimulus to the markets or economy.

Wall Street expected the FOMC to pitch added support for the bond markets and when the FOMC didn’t, bonds sold off, shooting mortgage rates higher.

Thursday, mortgage rates dipped again. Following the European Central Bank wrapping up a meeting with no plan in place, investors once again moved their money to the security of bonds, including mortgage backed securities.

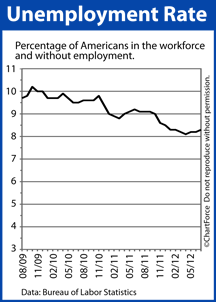

And to end the week, Friday saw the US Non-Farm Payrolls report blowing away analyst predictions of 100,000 new jobs when 163,000 were added in July. This sent the stock market up, and the bond markets down. Once the dust cleared, the 30 year fixed rate mortgage now sits at its highest level in almost 6 weeks.

In my article on Friday, Freddie Mac reported the 30 Year Fixed Rate at 3.55%, it now sits even higher.

Not much economic news is on the slate for this week, at least not economic news that generally moves the market. A lack of market moving news will cause Fed Chairman Ben Bernanke’s statements, if any, to potentially cause some movement.

My suggestion, if you have not yet locked in your interest rate, you may want to seriously consider locking it in, to take out the risk. Complete the Rate Quote Form to get started.