Mortgage rates worsened slightly last week as investors moved back into risk-taking mode. Better than expected economic data in the U.S. as well as a general feeling that the continuing Eurozone issues will be resolved soon (or at least lessened) contributed to a second week of climbing mortgage rates.

Mortgage rates worsened slightly last week as investors moved back into risk-taking mode. Better than expected economic data in the U.S. as well as a general feeling that the continuing Eurozone issues will be resolved soon (or at least lessened) contributed to a second week of climbing mortgage rates.

One of the better than expected pieces of economic data was the weekly Initial Jobless Claims report.

According to the U.S. Department of Labor, the number of U.S. workers filing for first-time unemployment benefits unexpectedly dropped 6,000 from the week earlier on a seasonally adjusted basis. Economists had expected a week-over-week increase.

In addition, government-backed mortgage securitizers Fannie Mae and Freddie Mac both announced quarterly profits last week of a combined $8.3 billion. This reflects well on the economy because both companies attributed strong results to a recovering housing market.

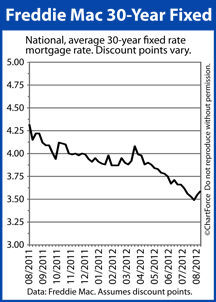

Conforming rates in Cincinnati rose for the second straight week, according to Freddie Mac’s weekly mortgage rate survey.

The 30-year fixed rate mortgage rate now averages 3.59% nationwide for mortgage applicants willing to pay 0.6 discount points plus a complete set of closing costs where 1 discount point is a loan fee equal to one percent of your loan size. This is a 10 basis point increase from late-July, when rates averaged 3.49%.

The 15-year fixed rate mortgage also moved higher, registering 2.84% last week after recently posting at 2.80%, on average.

This week, there isn’t much data to move markets. We’ll see the release of the Producer Price Index and the Consumer Price Index — two inflationary gauges for the U.S. economy — as well as July’s Retail Sales report. Beyond that, however, there isn’t much. Therefore, be wary of day-to-day momentum in the mortgage bond market.

Between January and July, momentum took mortgage rates lower; eventually to an all-time low. Since August 1, however, that momentum has reversed.

If you’re floating a mortgage rate or are otherwise not yet locked, get with your loan officer quickly. Mortgage rates may fall between today and Friday, but there’s much more room for rates to rise instead.