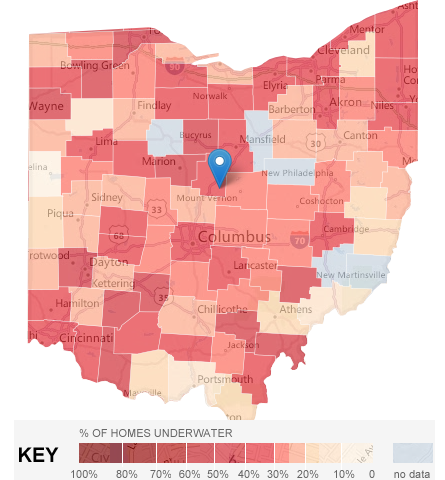

Recently Zillow released their “Negative Equity” map of the United States. The map shows the percentage of homes that are “underwater” or have negative equity. The data is presented county-by-county.

Below is Zillow’s Negative Equity Map of the Ohio

According to Zillow:

37% Hamilton County Properties are Underwater, and the average home value is $105,200

34% Butler County Properties are Underwater, and the average home value is $122,500

25% Warren County Properties are Underwater, and the average home value is $155,200

40% Montgomery County Properties are Underwater, and the average home value is $77,300

39% Franklin County Properties are Underwater, and the average home value is $109,900

24% Delaware County Properties are Underwater, and the average home value is $206,700

39% Cuyahoga County Properties are Underwater, and the average home value is $92,100

Zillow is a great resource for estimating property values, however not in the way that most people use it. When plugging in a property address you are presented with a “Zestimate”. This is Zillow’s estimate of the property value. And generally where people stop.

Past experience has taught me that the “Zestimate” is a very poor estimation tool. What is much more useful is viewing Recently Sold homes in the immediate area. Homes that are similar in square footage, number of bedrooms and bathrooms, similar construction style, etc. are a much better gauge on what a property is worth.

Assuming that Zillow’s Negative Equity Map is utilizing their own “Zestimate” values, then it could leave a lot to be desired.

HARP 2.0 refinances have been assisting Ohio homeowners in reducing their mortgage term (going from a 30 year to a 20 or 15 year) and lowering their monthly payments for 3 months now. If you would like to check your options for a Ohio HARP refinance complete the Ohio Mortgage Rate Quote Request form.