Rates are on the rise. There is no simpler way to put it. So if you have been on the fence, waiting for rates to dip back down into the 3’s, you may be waiting for quite a while, if not forever.

Rates are on the rise. There is no simpler way to put it. So if you have been on the fence, waiting for rates to dip back down into the 3’s, you may be waiting for quite a while, if not forever.

Freddie Mac’s Chief Economist, Frank Nothaft stated in November “..we look for fixed-rate mortgage rates to creep higher in 2014, gradually moving up throughout the year and ending at close to 5 percent”

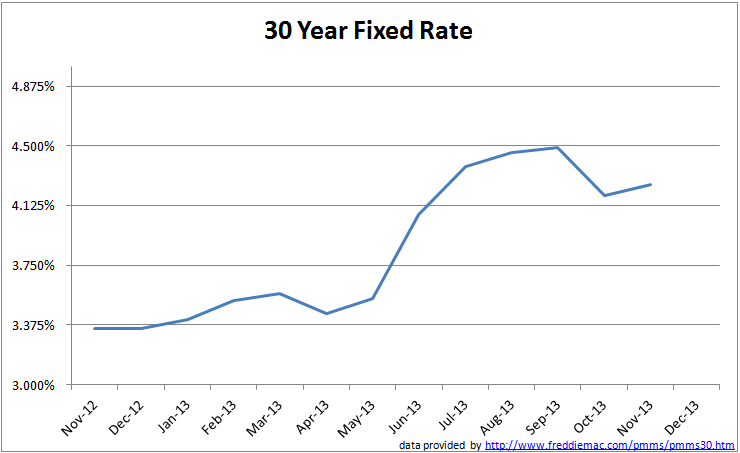

Below is the 30 year fixed rate charted from November 2012 through November 2013 (Freddie Mac has not yet posted December 2013 numbers).

Generally a poor economy leads to lower rates, keeping homes affordable. However, in recent months leading indicators (unemployment rate, etc.) have begun to show the economy is on the rebound, causing interest rates to begin to climb.

Another major contributor to rates increasing is the government. The Federal Reserve (the Fed) has hinted at phasing out Quantitative Easing sometime mid/late 2014. This means that the government will limit its purchasing of mortgage bonds (Mortgage Backed Securities), which it had been the primary purchaser of in efforts to keep mortgage rates low while the economy was doing poorly. At the December 18th Federal Reserve press conference, Ben Bernanke announced that the Fed will be reducing its purchase of MBS to $35 billion per month compared to the current $40 billion a month that the Fed has purchased.

So with the improving economy comes higher rates.

Click here for your own personalized rate quote whether you are seeking a Ohio FHA Streamline Refinance, Ohio HARP 2.0 refinance, or looking to move to a Conventional loan, or even shorten your term. Or you can Contact Me to discuss your situation.