Fannie Mae has just announced new Loan Level Price Adjustments (LLPAs) that go into effect for loans purchased on or before March 31, 2014. A mortgage must close, before it can be “purchased” on the secondary market.

Fannie Mae has just announced new Loan Level Price Adjustments (LLPAs) that go into effect for loans purchased on or before March 31, 2014. A mortgage must close, before it can be “purchased” on the secondary market.

My best guess is that lenders will begin to carry out these new LLPAs for loan submitted after February 1st, which would give them 60 days to close.

Loan Level Price Adjustments are set fees based on risk factors and loan to value (LTV). Although they are fees, they are generally not passed on to the consumer as a closing cost. Instead, they are priced into your interest rate, which would result in a higher interest rate.

Come the beginning of the year, Ohio residents can expect higher rates thanks to these updated Loan Level Price Adjustments from Fannie Mae. Click here to request a free, no obligation Ohio Mortgage Interest Rate Quote or Contact Me to discuss your options.

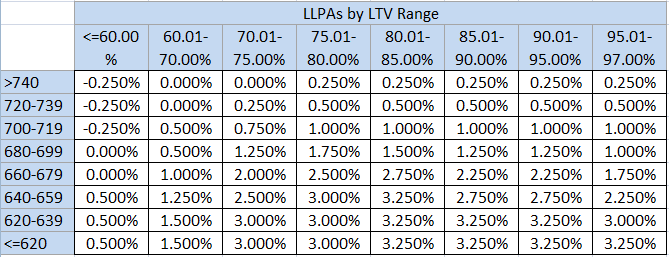

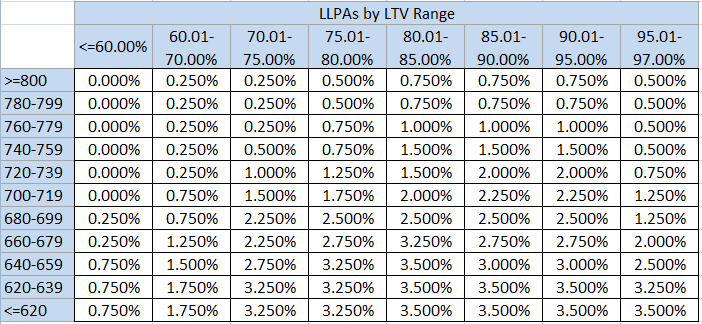

Below are 2 charts, one showing the current LLPA’s and the next showing the new LLPA’s effective sometime after the beginning of the year.

CURRENT OHIO FANNIE MAE LLPAs

[…] First good news of 2014. Last month I published an article about Fannie Mae’s new Loan Level Price Adjustments (LLPAs) and the impact they would have on Mortga…. […]